Marelich Mechanical Company, Inc. employs summer interns and new-hire project engineers from Northern California MCA student chapter programs. Chad Johnston, VP of Operations said, “Even with the circumstances we were still able to bring aboard seven summer intern and new-hire project engineers. We provide them a job opportunity, and most importantly give them experience in the plumbing and mechanical sector of the construction industry.”

Chad Johnston shares an overview of Marelich Mechanical’s onboarding process for interns and full-time hires:

New hires get the chance to spend a day in the main office meeting different department staff: Human Resources, IT, Safety, Purchasing, Estimating, Detailing, Design and Operations. The following days are typically spent riding around with the plumbing, piping, and sheet metal superintendents walking through various projects and fabrication shops to experience all aspects of Marelich operations beyond their specific project assignment.

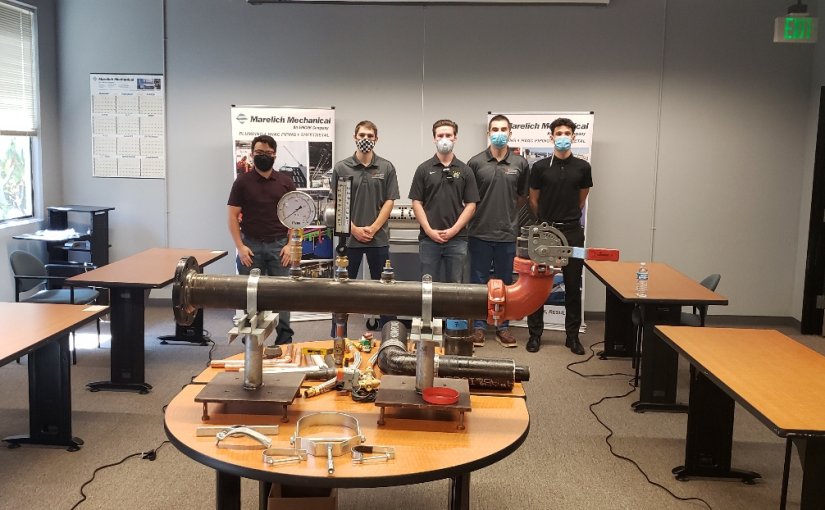

This summer, due to the impacts of COVID-19, the onboarding process was drastically modified. All new hires were brought into a mostly vacant office, meeting only a few essential individuals allowed in the office, with face masks used and social distancing maintained. No welcome aboard handshakes, no superintendent ride-along, no touring of multiple jobsites, and no group Marelich camping and rafting trip that have been done in past years.

Chad says, “Yes, things are different this year. For any new hire to any company right now, the empty offices, teams working remotely, and the mandated social distancing makes our organizations feel different than they did just a few months ago. Fortunately, we were able to continue our process of giving students of our Nor Cal MCA Student Chapters schools the opportunity for a career and experience in the industry.”

Below are just a few of the tasks interns and new-hires will be performing this summer:

- Reading and understanding project plans and specifications

- Writing, submitting, tracking, and resolving RFI’s

- Shop drawing submittals and tracking

- Processing equipment and material submittals and structural anchorage packages

- Managing equipment and material procurement and their releases to meet the project schedule

- Attending, documenting, and follow up for on-site meetings

- Developing labor loaded schedules; Tracking installed quantities and labor tracking

- Estimating, tracking and managing change orders

- Coordinating design changes with subcontractors & vendors

- QA/QC process follow-up

Chico State Interns

Marelich currently has three MCAA Student Chapter members of California State University, Chico interning this summer including, mechanical engineering major, Jimmie Whitton and construction management majors, Erich Anderson and Wyatt Hattich.

Wyatt Hattich is the retuning MCAA Student Chapter Vice President at Chico State. This summer, Wyatt is working on the HVAC in a luxury 19-story apartment building, Trinity Phase IV, in San Francisco. The largest Whole Foods in San Francisco is being built in the basement below the lobby of the apartments. Below the Whole Foods are five-floors of parking that will connect to the Trinity Phase III building next door.

Wyatt reflects on his experience so far as an intern, “What I really like about Marelich is that they all have made me feel very welcome in their company. They are all so open to help me succeed and learn new things about the mechanical industry. I am very grateful that Marelich allowed me to intern this summer and have given me such a positive experience.”

Full-time Chico State Hire

Ryan Smith graduated Chico State May 2020 with a Construction Management degree and just started full-time as a Project Manager with Marelich.

He is helping to manage the pipe fitters and sheet metal unions, focusing on HVAC work. During his experiences so far, Ryan has learned, “what truly make a great project manager is how you fix your mistakes when they arise.”

His current project is a San Francisco high end hotel and residential condo project. There are over 500 units between the hotel and condos, each has a fan coil unit which is connected to a VRF, and over five miles of refrigerant line.

“Since it is San Francisco we get to use cool tools like zoom lock which is like pro press. I process the submittals, RFI’s, IOM’s, and fix problems on the daily basis. San Francisco is a high stress environment but has some of the smartest individuals I have ever worked with. I thank MCAA for giving me such a great opportunity and for connecting me with such a great employer, Marelich Mechanical. Thank you for all you have done and for pointing me in the right direction.”

Start Your Search for Top Talent Today

Find student chapter members like Wyatt and Ryan by visiting MCAAGreatFutures.org, where members have access to student profiles and resumes. The profiles are searchable by university, desired location, and even a specific skill set, like BIM or AutoCAD. A keyword filter allows users to zero in on students who fit the bill.