Beginning January 29, 2023, certain construction projects that promote energy efficiency and clean energy production will qualify for substantially larger tax credits if they are done by contractors that employ apprentices from a registered program and pay prevailing wage. These enhanced incentives will provide a significant competitive advantage to signatory contractors with existing relationships with unions and experience complying with prevailing wage and apprenticeship standards.

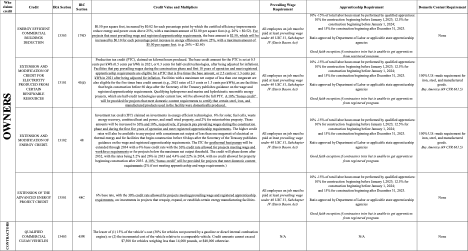

SUMMARY TABLE

WAGE AND APPRENTICESHIP REQUIREMENTS

Many tax credit enhancements are only available to facilities owners utilizing contractors that comply with the following requirements. We expect the federal government to issue more rules outlining specific compliance requirements. Please check back regularly for updates.

Wages: Owners must hire contractors that pay prevailing wage to their employees on the project, consistent with the Davis Bacon Act requirements (40 USC 31)

Apprenticeship: Owners must hire contractors that employ apprentices enrolled in a registered apprenticeship program, and meet the following thresholds:

- Percentage of Apprentices Hours on Project: 10-15% of total labor hours worked;

- 10% for construction beginning before January 1, 2023;

- 12.5% for construction beginning before January 1, 2024; and

- 15% for construction beginning after December 31, 2023.

- Total Labor Hours: the term ‘‘labor hours’’ means the total number of hours devoted to the performance of construction, alteration, or repair work by any individual employed by the taxpayer or by any contractor or subcontractor.

- This term excludes any hours worked by foremen, superintendents, owners, or persons employed in a bona fide executive, administrative, or professional capacity.

- Total Labor Hours: the term ‘‘labor hours’’ means the total number of hours devoted to the performance of construction, alteration, or repair work by any individual employed by the taxpayer or by any contractor or subcontractor.

- Apprentice to Journeyman Ratio: Ratio approved by Department of Labor or applicable state apprenticeship agencies

- Attachment of Requirements: Any contractor with at least four employees must employ at least one apprentice

- Good Faith Exception: If contractor seeks apprentice from a qualified program and is denied or the program fails to respond within five days.

GUIDES & FAQs

- White House: Building a Clean Energy Economy: A Guidebook to the Inflation Reduction Act’s Investments in Clean Energy and Climate Action

- Energy Efficient Commercial Buildings Deduction – p. 114

- Production Tax Credit for Electricity from Renewables – p. 13

- Investment Tax Credit for Energy Property – p. 14

- Advanced Energy Project Credit – p. 27

- Clean Heavy Duty Vehicles – p. 88

- Department of Labor (DOL): Prevailing Wage and the Inflation Reduction Act

- Apprenticeship.gov: Inflation Reduction Act and Apprenticeship Resources

TECHNICAL DOCUMENTS

- Internal Revenue Service (IRS) guidance on wage and apprenticeship requirements for enhanced credits/deductions

- 49 CFR 661.5 – Buy America Requirements

- n.b. The Inflation Reduction Act directs the IRS to apply these Federal Transit Administration Buy America requirements to certain clean energy tax credits.

- The Inflation Reduction Act of 2022

WEBINARS